Conservative Government: What next?

Since the days of Boris Johnson and in spite of then then 80 seat majority, the Conservative Administration has been plagued by both issues that they could not possible foresee and control and by situations that arose because of measures they took that turned into yet another crisis.Monday, 13 November 2023

Conservative government: What next?

Sunday, 7 August 2022

UK: In just a few weeks, the British economy could be in the doldrums and much stronger leadership will be needed

Saturday, 30 July 2022

A futuristic picture of Europe?

A futuristic picture of Europe?

Tuesday, 6 July 2021

July 19th 2021: time to go back to business as usual?

Sunday, 2 May 2021

Covid-19: Barclays Bank forecasts the bigges economic boom in the UK since 1948

The news is extremly encouraging and helped by good weather and the will of the British people to finally come out of the Lockdown period to start spending and enjoying their newly found freedoms might well be the key for more spending, faster turnout of monies spent and an explosion of optimism to get us out of the doom and gloom period to start runnning towards higher rates of exployment and of consumer satisfaction.

This happens when our neibouring EU countries are still in a muddle in what concerns Lockdowns, vaccinations and the number of infections and life losses and adding to this the climate of instability that leads to street protests and confrontation as countries like Germany and France are heading towards General Elections. One can only wonder what will be the outcome of those elections and the political repercussions across the European Union.

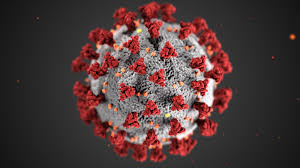

Covid-19 and the pandemic are health issues that have quickly turned out to be highly charged political issues in terms of competence of authorities to deal with health crisis and the willingness of elected representatives to pass ever more restrictive and in some case more repressive legislation.

We await the new dates for greater opening of Britain and we await also the outcome of experiments of social mass gatherings to detect the effects concerning the spread of infection.

Friday, 22 January 2021

From Covid-19 to B117: This could be like the plague that killed 50% of the population of Europe

From Covid-19 to B117. 70 per cent more contagious and more than 30 per cent more deadly. We are flowered. More than 25 per cent of those who recover will die within five months because of the damage done by the virus to vital organs.

Since no country can exist under a permanent Lockdown, financial collapse will follow leading to riots and revolutions that will destroy any democratic form of government.

This is Das Ende. If you live in an area of the world where the pandemic is not an imminent danger coming to Developed World is the equivalent of committing suicide. Refugees and illegal imigrants are effectively migrating to die a most horrible death in the Developed World.